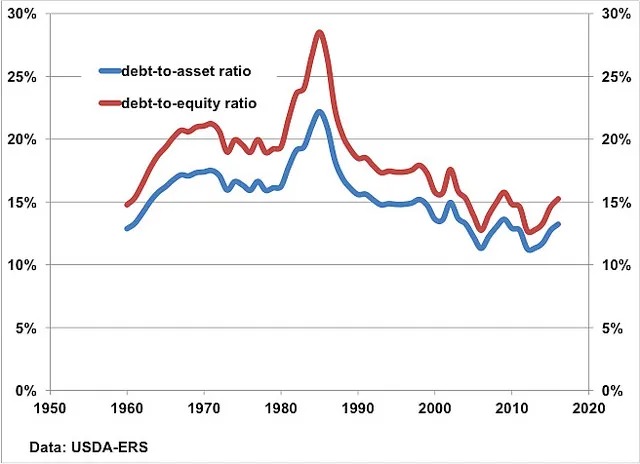

AI/ML in debt collection offers automated process planning and execution, enabling faster operations and bringing a 2-4x increase in collectors’ productivity.

We have successfully implemented predictive models at major clients in the telecom, banking and outsourcing industries.

All data models and algorithms are developed based on the data of the company for which we perform the analytical services, being customized to be used by the company for which we performed these services.

The developed models can be applied to:

We have successfully implemented predictive models at major clients in the telecom, banking, financial industries. The models were implemented in the field of risk management, acquisition of new clients, credit limits management, debt collections and accounts receivables

The observed results are the following:

AI models can spot small changes in behavior that suggest a borrower is struggling, allowing for early outreach.

AI models analyze business data, such as behavior, cash flow and market trends, to predict how likely a small business is to repay its loan.

AI can bring together data about the housing market, the borrower’s financial situation, and economic trends to create a more complete picture of repayment risk.

Payment behavior scorecards help lenders target the right people at the right time with personalized repayment plans, leading to better recovery.

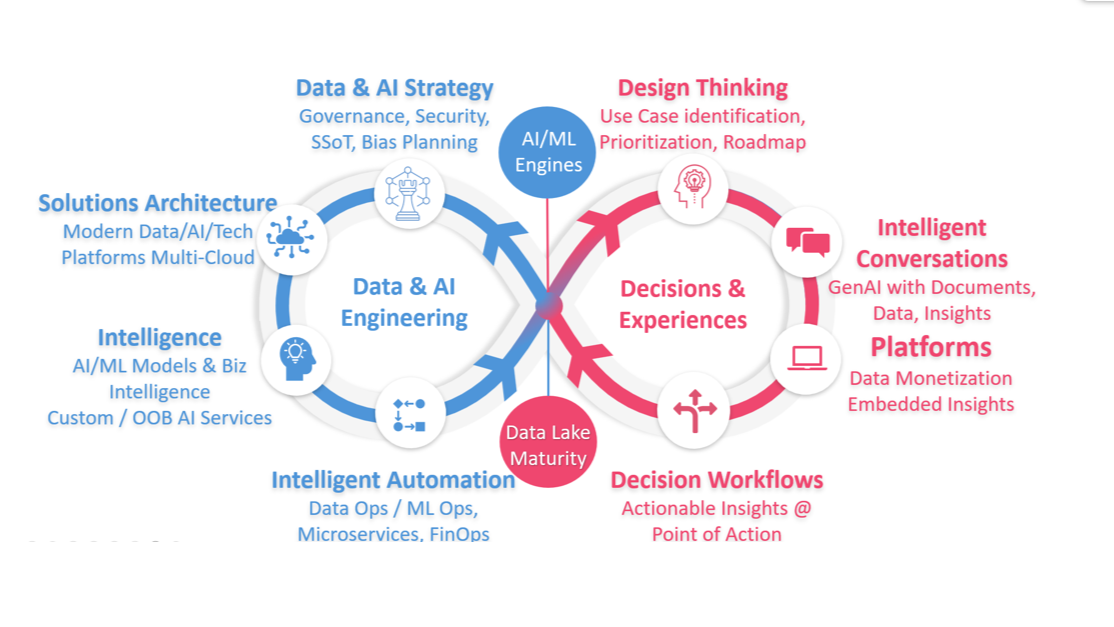

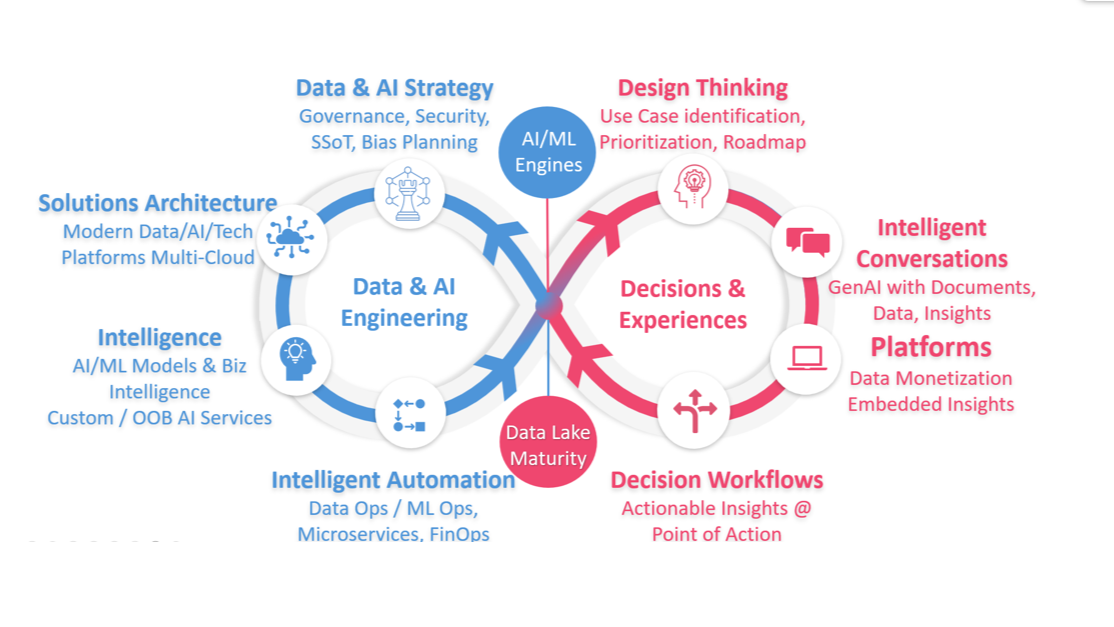

DESCRIPTIVE STATISTICAL ANALYSES

Descriptive analyzes provides a summarized view of a customer segment or the entire customer base, which will allow the management of the company to determine further directions to investigate or prioritization of analyzes or changes to existing processes.

CAUSE-EFFECT CORRELATION ANALYSES

Correlation analyzes determine the causes that led to a certain result or to learn more about the company's customers regarding a certain behavior of theirs.

PREDICTIVE ARTIFICIAL INTELLIGENCE MODELS

Predictive analytics models are created to evaluate past data, uncover patterns, analyze trends, and leverage that insight for forecasting future trends.

Decision trees and matrices - Used to divide customers or certain situations into relatively homogeneous groups and make a decision for each group

Logistic regression (scoring) Used to estimate the probability that a case (e.g. customer, request, situation) will have a certain outcome (e.g. purchase, non-payment, abandonment of services)

Support Vector Machine (SVM) Alternative to logistic regression. The model estimates whether a case (e.g. customer) will have a certain outcome (e.g. non-payment)

Neural networks: Create multiple connections between the characteristics of the subjects studied (e.g. customers, requests) and a specific outcome (e.g. purchase, non-payment)

Automatic classification. Automatically classify the subject (e.g. customers, requests) into homogeneous groups so that the differences between the groups are as large as possible

Recommendation systems: Make recommendations to customers for new services or products; recommendations are based on analysis of previously expressed preferences

We can provide you with a set of free studies on technology evolution and risks, or you can request personalized analyses.