80% of Wall Street firms are studding and implementing AI Financial services executives report seeing an increase in quantifiable value from AI investments in the fifth annual Broadridge survey.

Market data providers like Bloomberg and FactSet use generative AI to boost productivity for their users. Federal Reserve Gov. Michael Barr said the advent of generative artificial intelligence promises to boost bank productivity, but banks should be careful in choosing AI partners to delineate data security responsibilities.

As AI becomes more pervasive, the tech industry has an important role to play in funding and scaling energy technologies as well as making chips, algorithms, and models more efficient, according to Deloitte. With Trump Tariffs, even AI could get more expensive. Higher prices may be in store for a range of materials used to build the data centers that will deliver AI.

–The real risk of doing nothing

Many banks and credit unions hesitate to modernize their payment infrastructure, not because they don’t see the need – but because they don’t see immediate ROI. This inertia leads to shortsighted decisions, patchwork fixes, and mounting complexity that slows time to market and stifles innovation.

The Competitive Gap: 60% of large businesses and 75% of SMBs are already shifting to non-bank payment providers—banks that don’t modernize risk losing relevance.

The Budget vs. Execution Divide: Many banks allocate funds for modernization, but complexity, risk aversion, and lack of a clear roadmap slow execution.

The Business Case is Clear: Proven ROI includes increased straight-through processing (STP), improved customer experience, and faster time to market.

Meanwhile, forward-thinking banks are breaking free from legacy roadblocks, ensuring compliance readiness, delivering superior customer experiences, and adapting seamlessly to new payment channels. The key difference? They’ve invested in cleaning up their backend payment infrastructure – not just layering on cosmetic front-end fixes. By: Frank Gargano

__

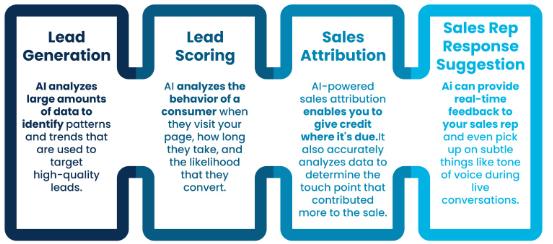

The rapid advancement of data access, AI is changing customer acquisition, payments, receivables collection and loyalty by improving 10 to 20% the return on investment (ROI).

Citigroup has begun moving some software applications from its data centers to Google Cloud and is experimenting with Google’s AI technology through a multiyear agreement.

The bank plans to start with enterprise analytics, high performance computing for its markets business, desktop solutions for employees including customer service agents, and customer-facing apps. The move is part of a broader modernization effort that Citi CEO Jane Fraser mentioned in several earnings calls. It’s also part of an industry-wide shift toward cloud computing that has some regulators worried.

Citi is the latest large bank to announce a major move to cloud computing. In 2020, Capital One closed all its data centers and moved everything to Amazon Web Services. In 2021, JPMorgan Chase said it would use a cloud-based core banking system from Thought Machine for its retail bank, and Wells Fargo said it would migrate several applications to Microsoft Azure and Google Cloud. The next year, KeyBank said it would put primary applications in Google Cloud and U.S. Bank planned to move most applications to Microsoft Azure.

In a separate project, Citi’s developers continue to use GitHub Copilot to speed up their work.

Concerns?

The Treasury Department came out with a report last year that raised many concerns about the increasing use of cloud computing in financial services. Among them were issues around security, resilience, incident disclosure and response, concentration risk (too many banks relying on a small number of vendors, like Microsoft, Google, Amazon and IBM) and imbalances of power between bank users and large tech company providers.

Pro-Russia hackers target Italian banks in apparent DDoS attack.

A pro-Russia hacker group, NoName057, said it attacked the websites of various Italian institutions this week, starting with large banks. The hackers said they were reacting to a speech by Italian president Sergio Mattarella that compared Russia’s invasion of Ukraine to the „wars of conquest” by the Nazis.

Banks operating in the European Union will need to reach compliance next days with a major new law governing the stability of the financial system’s computer systems. Among other requirements, banks will be expected to monitor the risks presented by third-party technology vendors — a growing focus for U.S. regulators, as well.

Biden’s cybersecurity order could help banks deter fraud. President Joe Biden issued an executive order that could — if implemented by the incoming administration of Donald Trump — help banks and credit unions reduce fraud and financial crimes by improving the process for verifying government-issued identity information from customers and applicants.

Bad news for Cybersecurity institutions recruiting, talent shortage for Cybersecurity is growing. Job opportunities for cybersecurity specialists continue to grow significantly faster than other occupations, and cybersecurity experts are in high demand, especially in the financial services industry.

Behavior scorecards can help lenders:

RISK

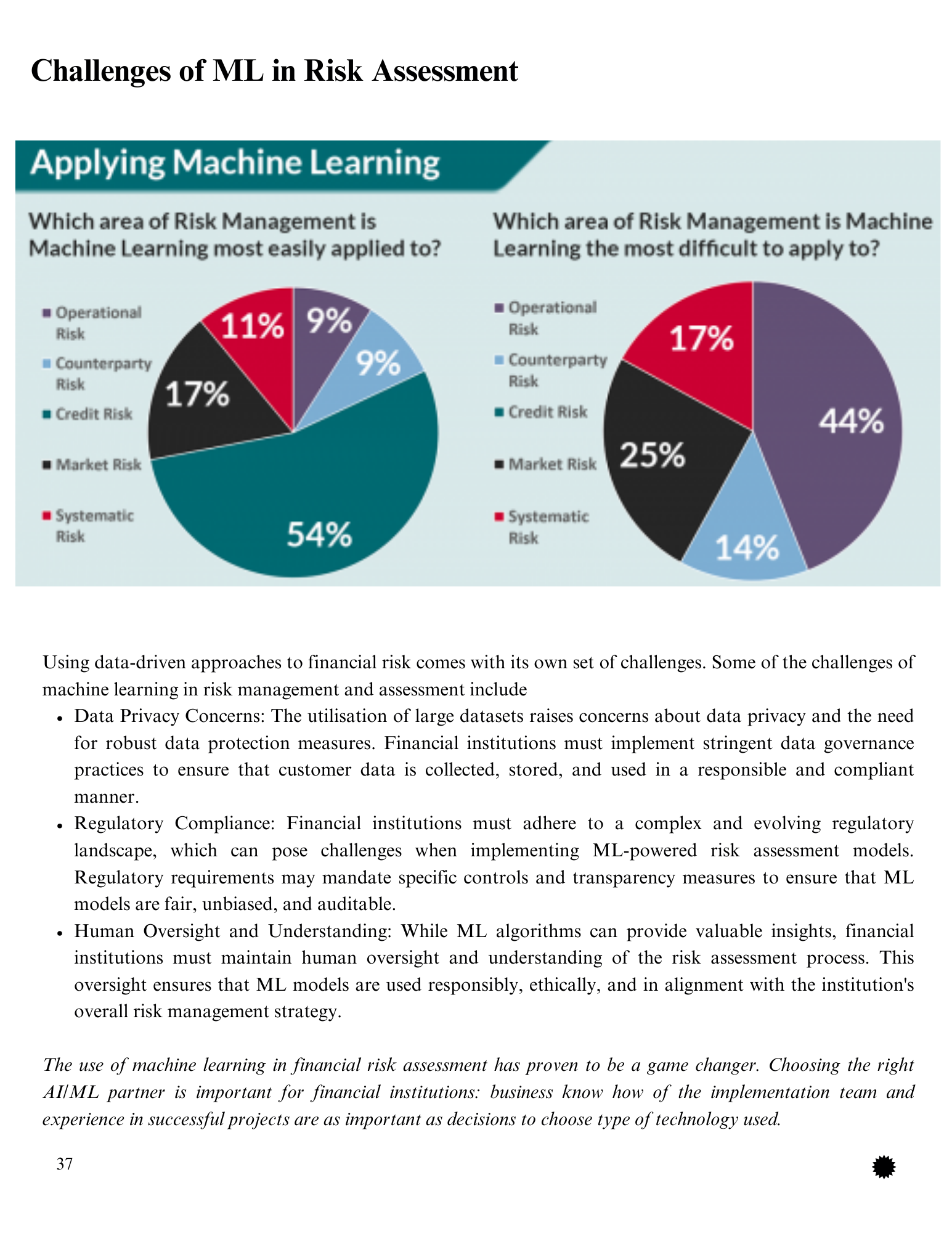

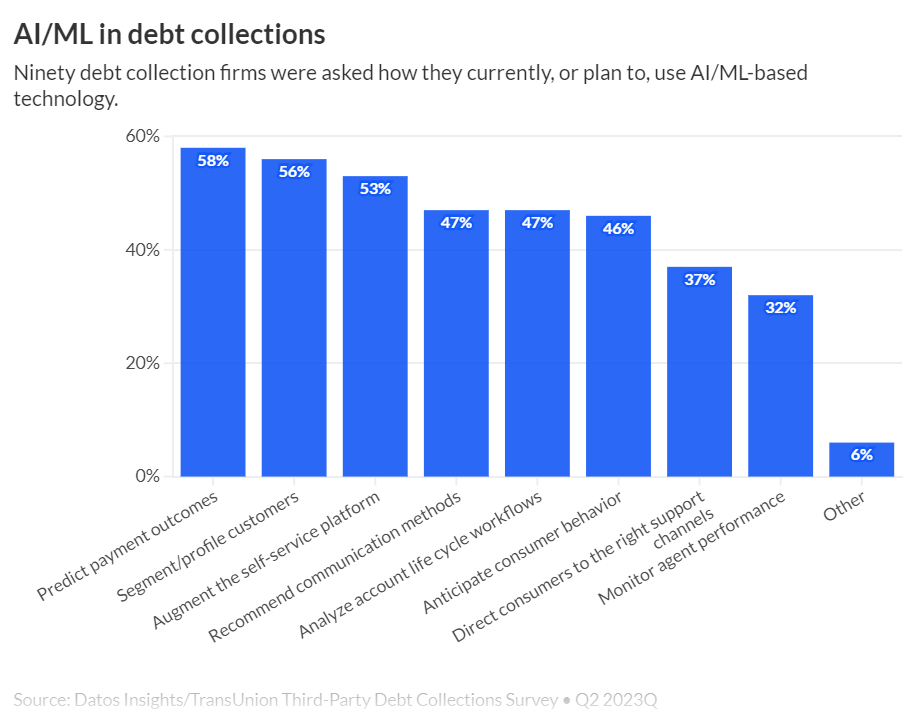

By combining traditional scorecards with ML models, financial institutions can create effective collections strategies tailored to each type of loan. This helps increase ROI based on improved recovery rates, and efficiency, ensuring better outcomes for both lenders and borrowers.

Using scorecards for customer behavior and other predictive models, whether traditional or based on machine learning (ML), can help improve collection rates and make the process more efficient.

Case Example: Improving Collections for Unsecured Loans

A provider of unsecured loans used a mix of traditional scorecards and machine learning models, resulting in a 20% improvement in collections. The combination of early-stage borrower segmentation (using scorecards) and real-time analysis of borrower behavior (using ML models) helped target the right borrowers at the right time, improving recovery rates while cutting costs.

Nonbank lenders have gained market share in the SBL market globally

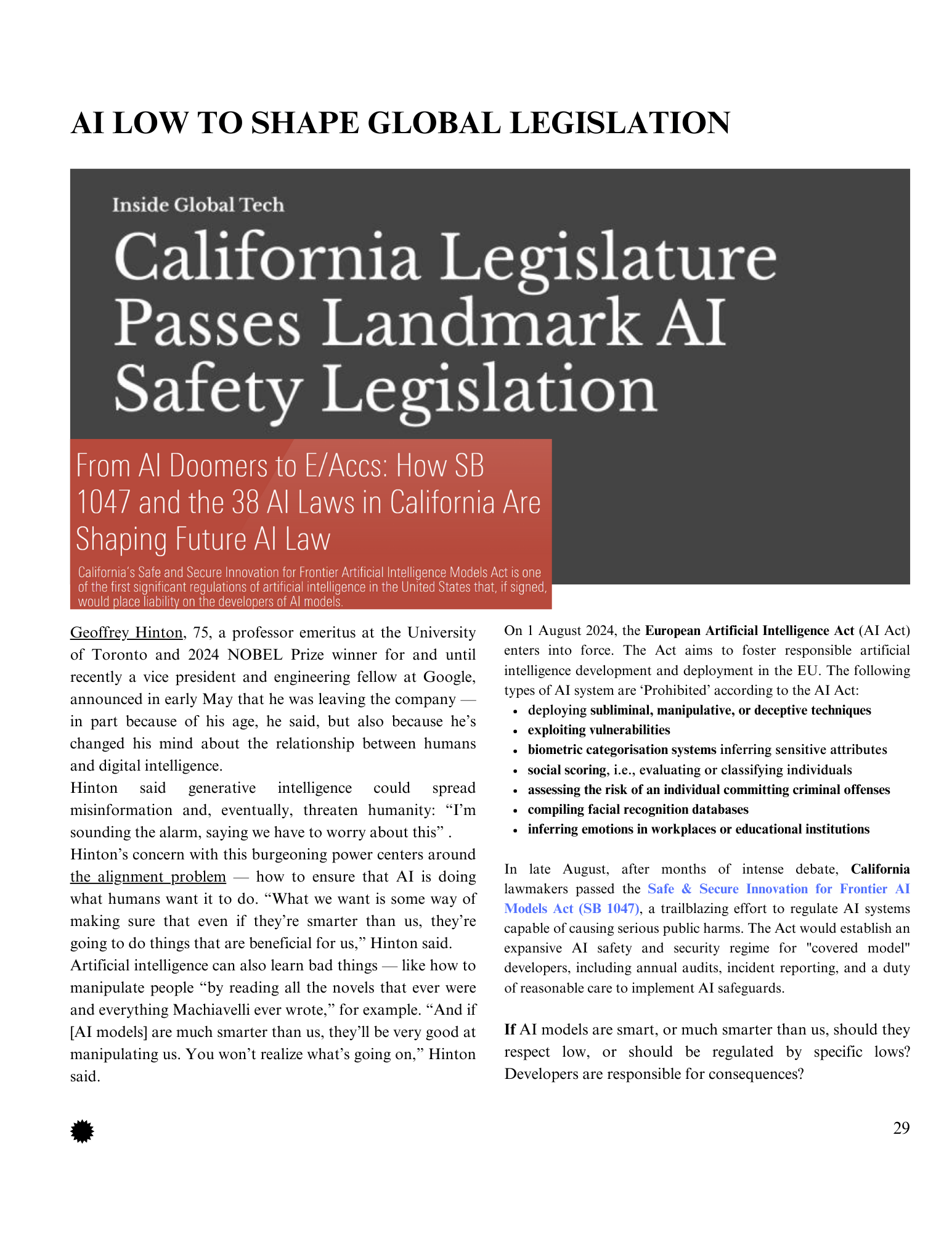

According to a PwC report, Artificial Intelligence could contribute close to $15.7 trillion to the global economy and could be a massive opportunity.

“Small-business funding has become very data-heavy and data-driven, and there’s now much more cash-flow-based funding for small businesses than ever before.”

Academic point of view.

Technology change vs “how institutions are formed".

“Reducing the vast differences in income between countries is one of our time’s greatest challenges. The laureates have demonstrated the importance of societal institutions for achieving this,” (Jakob Svensson)

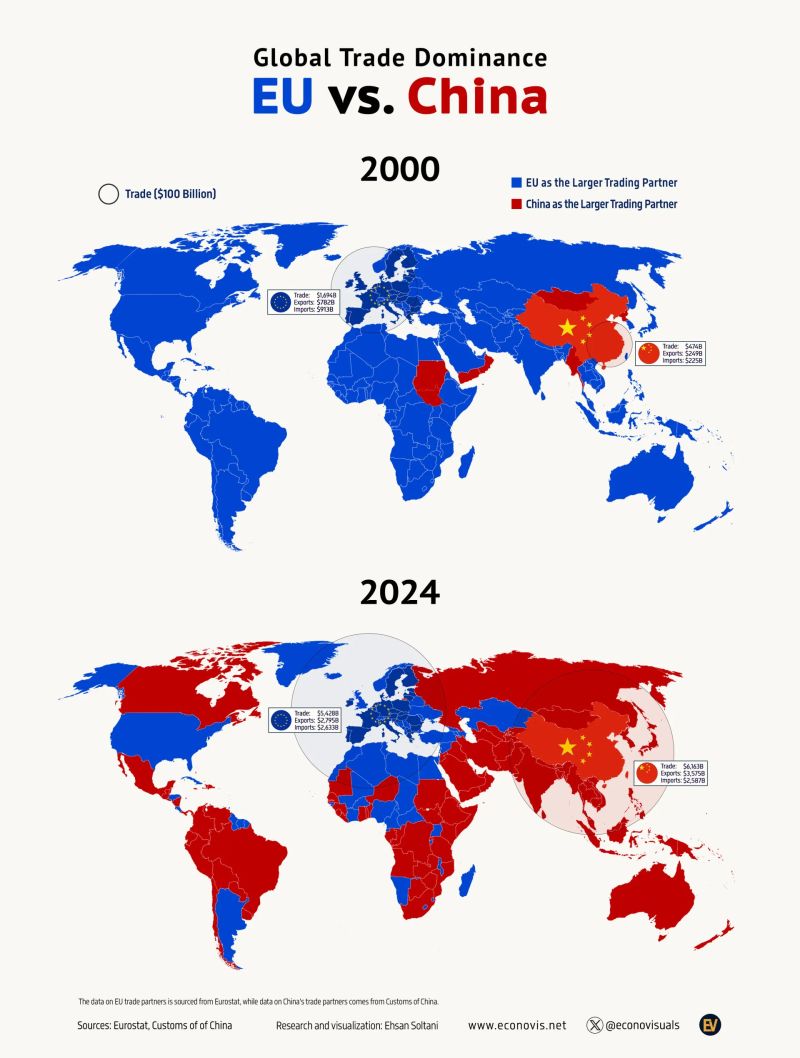

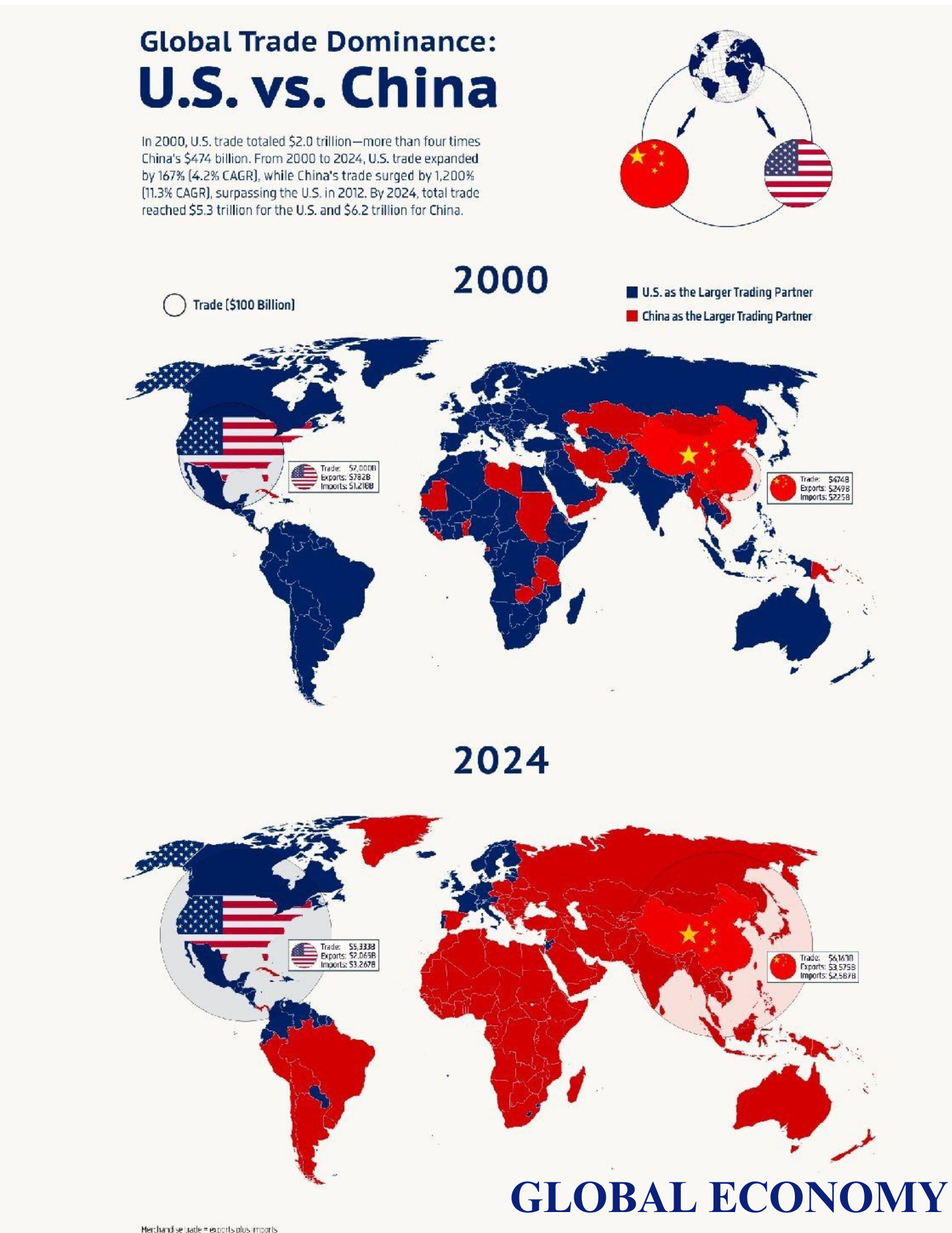

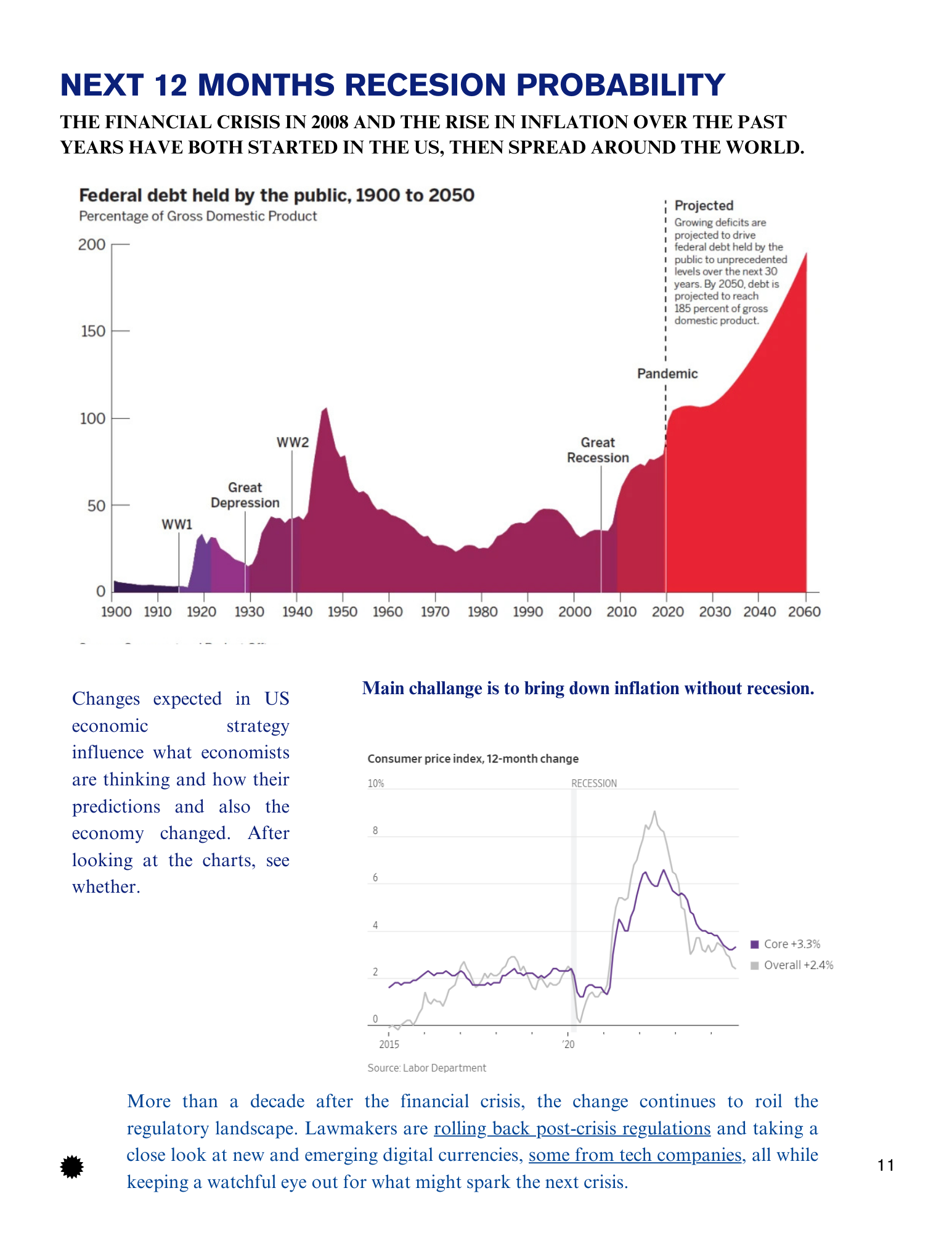

Geopolitical tensions may spark from failure of economic policies, significant technology change, or geopolitical games, often linked with group interests divergent with country wealth, and also the weakened state power.

US efforts to establish what resembles a hegemony in Europe and other parts of the world as a "77-year war" (from the WW1 to the fall of the USSR), has dominated the last phase of Western Civilization. (Prof Neagu Djuvara)

At a global level, the growing divide between academia and industry means that research is increasingly concentrated where technology firms are most capable of developing advanced systems. In today’s economy, that’s the United States and China — the former benefiting in part from an influx of talent from other countries, the latter from the rapid rise of data-rich platforms such as WhatsApp — and, to a lesser extent, Canada. Europe, on the other hand, runs the risk of falling further behind.

Take your business to the next level with AI/ML solutions.